Primarius Blog - Audit insurance FY24

Muriel Oliver

Update | 20 Jun 2023

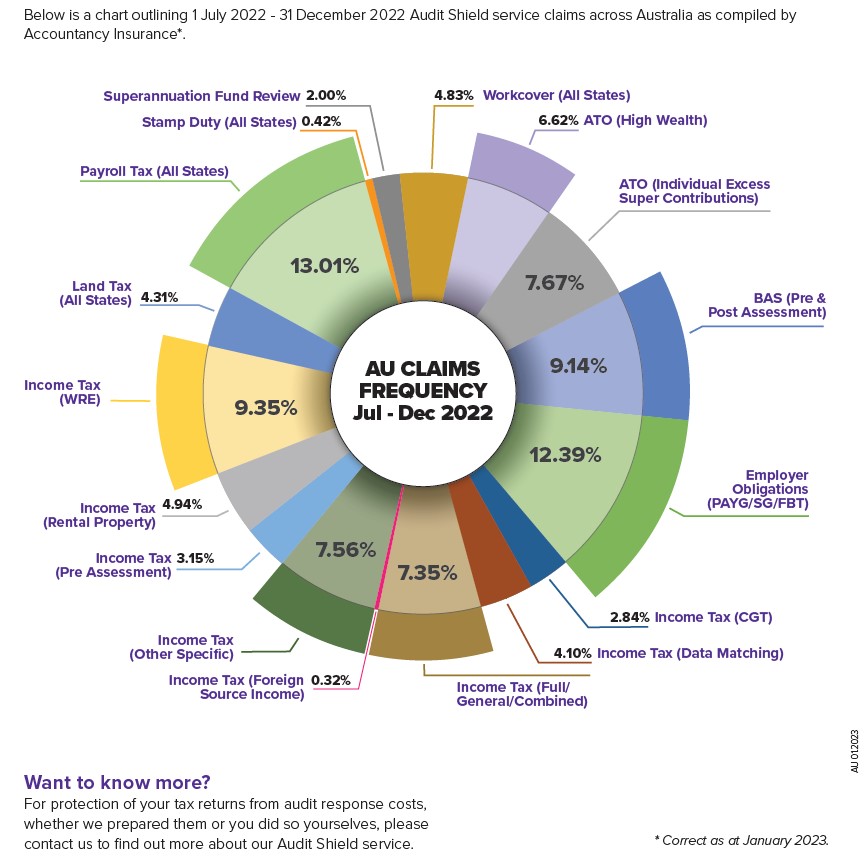

We offer tax audit insurance to all our clients every year. This means our clients are covered for any Australian Taxation Office (ATO) or Office of State Revenue (OSR) audits or investigations. In our experience responding to audits can be very time consuming and therefore costly, not to mention stressful and tiring. We advocate taking out tax audit insurance to cover the cost of this risk. As you can see from the graph that they kindly supplied to us detailing July to December 2022 audit insurance claims. This shows the main current audit targets are Payroll tax, Employer obligations, BAS, income tax and ATO Individual excess superannuation contributions.

Last year the audit activity was as follows - FY22 audit insurance update

Our Primarius policy is through Accountancy Insurance - click here for more information. You may find a tax audit policy through your business broker, and we don't mind which you choose, we just recommend that you ensure you are covered.

Disclaimer: This information is general in nature. So, before acting on this or any other information, it is important to seek professional advice related directly to you and your circumstances. Should you require our assistance, contact your Primarius Team leader, or email us at info@primarius.net.au

Liability limited by a scheme approved under Professional Standards Legislation